By: Jordan Golson

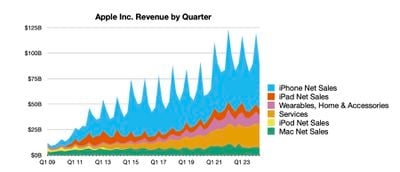

Apple today announced financial results for the second fiscal quarter of 2024, which corresponds to the first calendar quarter of the year.

Gross profit for the quarter was 46.6 percent on a year-over-year basis. compared to 44.3 percent. percent in the previous year's quarter. Apple's board of directors also authorized an additional $110 billion in share repurchases and announced an increase in dividend payout to $0.25 per share, up from $0.24 per share. The dividend is payable on May 16 to shareholders of record as of May 13.

“Apple today reported revenue of $90.8 billion for the March quarter, including record service revenue,” said Tim Cook, Apple CEO. “This quarter, we were excited to launch Apple Vision Pro and show the world the potential that spatial computing unlocks. We're also looking forward to an exciting product announcement next week and an incredible Worldwide Developers Conference next month. As always, we are focused on providing our customers with the very best products and services, while living the core values that drive us.”

It has been that way for over four years. Apple will now again not issue guidance for the current quarter ending in June.

Apple will provide live coverage of its fiscal second quarter 2024 earnings conference call at 2:00 pm PT, and MacRumors will add this story, highlighting the highlights of the call.

Recap of the call ahead…

13:40: After today In regular trading, Apple's stock price rose another 6% in after-hours trading following the earnings report.

1:43 p.m. >: Services and Mac were the only Apple segments to see year-over-year growth, with Services up nearly $3 billion and Mac sales up about $300 million. But with iPhone Apple's overall revenue fell by about $4 billion. However, the increase in gross profit meant that Apple's net income fell by only about $500 million, and as Apple's share count continues to decline as share repurchases occur, earnings per share actually rose by a penny compared to last year.

14:01: The call begins with the usual cautionary statements regarding forward-looking statements. Apple CEO Tim Cook and CFO Luca Maestri are on the phone.

14:02: Tim is on the phone, reporting $90.9 billion in revenue and record earnings per share. $1.53 for the March quarter.

14:03: It touts revenue records in a number of countries and regions, including March quarter records in Latin America, the Middle East and in other countries. Canada, India, Spain and Türkiye.

14:03: He notes that in the year-ago quarter iPhone Demand increased due to supply disruptions and channel restocking – “We estimate this one-time impact added nearly $5 billion to revenues for the March quarter last year. If we exclude this from last year's results, our company's total revenue for the March quarter increased this year. year would have grown.”

14:04: Now let's talk about Apple Vision Pro and find out that half of the Fortune 100 companies have bought Apple Vision Pro units and are exploring ways their use in business. “Exciting product announcement” next week “that we think our customers will love.”

14:05: Mentions WWDC in June and says, “We continue to be very optimistic about our capabilities in generative AI. We're making a significant investment and look forward to sharing some very exciting things with our customers soon. We believe in transformative possibilities. the power and promise of artificial intelligence, and we believe we have advantages that will differentiate us in this new era, including Apple's unique combination of seamless integration of hardware, software and services, revolutionary Apple silicon with our industry-leading neural engines and our unwavering focus on privacy, which is at the core of everything we create.”

14:06: Now on to iPhone Revenue was $46 billion, down 10% year-on-year, but marking growth in mainland China and the iPhone 15 and 15 Pro Max becoming the best-selling smartphones in urban China.

2:06 pm: Reports that he has visited China, Vietnam, Indonesia and Singapore and that customers and communities love Apple, which is one of the many reasons he is so optimistic about the future.

14:07: Switch to Mac: Revenue was $7.5 billion, up 4% year over year. New 13- and 15-inch MacBook Air with M3 released.

14:07: iPad, $5.6 billion, down 17% year-over-year after the M2 iPad. Pro and iPad 10th generation in the last fiscal year.

14:08: Revenue from sales of wearables, home products and accessories was $7.9 billion, down 10% due to for a complex comparison of Apple Watch and AirPods. He notes that Apple uses artificial intelligence and machine learning for fall detection and heart rate notifications.

14:09: Services was the best-performing category for the quarter. $23.9 billion, up 14% year over year, with record revenue across several categories and geographies.

14:09: Apple Sports iPhone&zwnj mentioned ; app.

14:10: Now on to retail, mentions a new store in Shanghai and that “the energy and enthusiasm of our customers is noteworthy.” Demo versions of Vision Pro delighted customers and provided deep and emotional impressions from their first use.

14:10: Apple wants to enrich users' lives by making Apple Podcasts more accessible with a new transcription feature, new encryption protections in iMessage, and environmental efforts to make products carbon neutral.

14:12: Apple is investing in new solar and wind energy, working with partners in India and the US to replenish water use, and has committed $200 million to projects to naturally remove carbon dioxide.

2:12 pm: He calls this year a year of unprecedented innovation.

14:12: CFO Luca Maestri will come to discuss the results in more detail.

14:13: Revenue was $90.8 billion, down 4% from last year. Foreign exchange rates had a negative impact of 140 basis points.

Products totaled $66.9 billion, down 10% year-over-year, driven by a challenging comparison to iPhone, partially offset by Mac.

14:14: Gross margin was 46.6%, up 70 basis points sequentially, driven by cost savings, a favorable service mix, partially offset by leverage. Product gross margin was 36.6%, down 180 basis points sequentially. Services gross margin was 74.6%, up 180 basis points from the prior quarter. Operating expenses were $14.4 billion, at the midpoint of the guidance range, and up 5% year over year. Net income was $23.6 billion and diluted earnings per share were $1.53, which was a March quarterly record. Operating cash flow was $22.7 billion.

14:15: Setting for one-time use iPhone impact, iPhone Revenue will be about the same as last year. iPhone The active installed base grew to new record levels both overall and across all geographic segments. In the March quarter iPhone was the best-selling model in the US, China, Australia, UK, France, Germany and Japan. iPhone 15 continues to be very popular with customers, with 99% customer satisfaction in the US.

14:16: Mac revenue was $7.5 billion, up 4% Last year. the power of the new MacBook Air with M3 chip. The Mac base reaches a new all-time high: half of the MacBook Air buyers are new to the client. Mac customer satisfaction was 96%.

14:16: iPad amounted to $5.6 billion, which is 17% less than last year. Half of the buyers are not familiar with the product, 96% are satisfied.

14:17: Wearables, Home and Accessories sales totaled $7.9 billion, down 10% year-on-year, with the launch of the 2nd generation AirPods Pro, Watch SE and Apple Watch Ultra last year. Apple Watch installations hit a new all-time high, with two-thirds of customers new to the product. Customer satisfaction was 95%.

14:18: Services reached $23.9 billion, up 14% from last year. The installed base of active devices continued to grow. The number of transactions and paid accounts reached new all-time highs, with the volume of paid accounts growing by double digits year on year. More than 1 billion paid subscriptions, more than double the number four years ago.

14:18: New games on Apple Arcade and new shows on Apple TV+ mentioned.

14:18: In enterprises, customers continue to use Macs. In the healthcare industry, Epic recently launched its own Mac app that allows hospitals to migrate to the Mac for clinical use.

14:19: KLM uses Apple Vision. Pro to train aircraft engine mechanics, and Lowes is using it for immersive kitchen design.

14:20: Apple's revenue was little changed in the first half of its fiscal year, despite one week of fewer sales and currency difficulties. Revenue records in the first half of the year were recorded in Latin America, the Middle East, India, Indonesia, the Philippines and Turkey. First-half diluted earnings per share were $3.71 per share, up 9% year-over-year.

14:21: The quarter ended with $162 billion in cash and marketable securities. Debt is $105 billion and net cash is $58 billion. $27 billion was returned to shareholders, including $3.7 billion in dividends and $23.5 billion through open market repurchases of 130 million shares. The board approved $110 billion in share repurchases and a 4% dividend increase to $0.25 per share.

2:22 p.m.: June earnings expected will grow by single digits year on year despite 2.5% headwinds in the foreign exchange market. In services, growth will be in the low double digits, similar to the first half of the year. iPad grow by double digits. Gross profit from 45.5 to 46.5. Operating expenses from $14.3 to $14.5 billion. Tax rate will be about 16%.

14:22: Q&A with analysts begins.

14:24: Question: Regarding the June quarter guidance, low single digit revenue forecast, can you talk about the assumptions for the product, iPhone, what gives you confidence in this ? What was better than expected in the service sector?

A: We expect the company's growth to be in the low single digits, and we expect our services business to grow at a double-digit rate, similar to the first half of the fiscal year. iPad should grow by double digits. This is the color we are providing for the June quarter.

In Services, we are seeing very strong performance across the board, with records in several categories and geographic segments. This is a very broad concept. The subscription business is doing well. The number of transactions and paid accounts is growing by double digits. We are seeing good results in both developed and emerging markets.

14:26: Question: Should we expect changes in historical capex dynamics along with changes in AI, changes in the way we think about the separation between tools, data centers and objects?

A: We are very excited about this opportunity, we are actively pushing innovation on all fronts, and we have been doing this for many years. Over the past five years, we have spent more than $100 billion on research and development. At CapEx, we have a hybrid model where we make some investments ourselves and share them with suppliers and partners, we buy some of the tools and production equipment, and some of our suppliers buy things. It's the same with data centers. This model has historically worked for us, and we plan to continue this way.

14:27: Question: What are the changes and implications for Apple? from third-party EU app stores could degrade the user experience but also reduce Apple's revenue. What are developers and consumers doing?

Answer: It is too early to answer a question that was just implemented in the EU in March. We are committed to compliance while mitigating the impact on user privacy and security. That's our goal.

14:28: Question: In terms of gross product margins, you mentioned mix and efficiency…do people mix between product lines? An attempt to gain insight into customer behavior.

A: Consistently, we failed, primarily because we had a slightly different set of products than the previous one. Leverage plays a big role as we move from the holiday quarter to a more typical quarter. First of all, leverage and a different set of products. We didn't see anything special.

14:29: Question: I mentioned the hype around GenAI a couple of times. There were a few different ways to monetize, and historically Apple hasn't generated much revenue from software update cycles. How can you explain this?

A: I don’t want to interfere with our announcements. We see generative AI as a key capability across all of our products and believe we have advantages that set us apart, which we will be talking more about in the coming weeks.

2: 31 pm: Question: There is widespread concern that rising commodity prices will negatively impact your gross margins. When you think about all the commodities that go into products, are they going up or down and what tools do you have to mitigate the impact?

A: During the last quarter, commodity and component costs behaved favorably for us. Memory prices are starting to rise. They rose slightly during the March quarter. It's been a period, not just this quarter but the last few, where commodities have been good to us. They go in cycles, so it's always a possibility – we're starting at a very high gross margin level – 46.6% – something we haven't seen in decades, starting off at a good point. We try to buy forward when cycles favor us, so we'll try to mitigate if there are headwinds, but we're in good shape especially for this cycle.

14:33: Q: Are there any more colorings after your visit to China? I know you remain confident there in the long term, but is there any color as to when things will change?

A: If you look at our second quarter results in Greater China we decreased by 8%, which is an acceleration compared to the first quarter. The main driver was the iPhone, and if you look at the iPhone in mainland China, we grew as per reports, prior to any normalization of supply disruptions. If you look at the best-selling smartphones, iPhones are the top two in urban China. It was a wonderful visit while I was there: we opened a new store in Shanghai and the welcome was very warm and energetic. I left there having had a fantastic trip and loved being there. I have a great long-term view of China, I don't know how each quarter and week goes, but I have a very positive long-term view.

14:34 : Question: There are concerns that you may lose some of the revenue from driving traffic, and I'm wondering if you think that AI, when you look at the big picture and in the long term, will be an opportunity for you to continue to monetize real mobile traffic? estate from the big picture. Is there a big picture that you can give and how to monetize that?

A: I think AI, generative AI and artificial intelligence are big opportunities for us across all of our products. We'll talk more about this in the coming weeks, but I think there are a variety of ways that work for us. We believe we are well positioned.

14:36: Question: Last quarter you talked about being successful in the enterprise sector, will your AI also be consumer AI? and corporate? ?

A: During this quarter and prior quarters, we focused on the enterprise segment of iPhone, iPad and Mac sales, and recently added Vision Pro. We're excited about what we're seeing there in terms of interest, and large companies are buying some of them to explore ways to use them. I see huge opportunities in entrepreneurship. I would not like to associate this only with artificial intelligence. I think we have a big business opportunity around the world.

14:37: Question: There is a shift towards the Pro model, there is growth in the services sector, but weakness in products. ?

A: Customers want to purchase the best product we offer in each category. We have done our best to make it easier for our customers through financing and other programs. Shoppers want to buy the highest quality products, but in emerging markets, where affordability issues are more pronounced, we are seeing a trend where this is becoming more sustainable.

14:39 >: Question: In terms of capital allocation, net cash is $58 billion. As you get closer to net cash neutrality, will you ever use leverage on the balance sheet, or once you get to net cash neutrality, how do you look at leverage or bringing free cash back into the balance sheet? shareholders?

Answer: I would say, step by step. We set a goal of being net cash neutral, we worked hard to get there, our cash flow was very strong. We have increased the buyback allocation, let's get this done first, it will still take some time. Once we reach that goal, we will re-evaluate the optimal capital structure for the company.

14:41: Question: Regarding the China discussion, could you take a step back? these numbers are still down compared to last year. What do you see at the macroeconomic level in China, do you think it is a macro or micro movement there?

A: I can only tell you what we see, I don't want to introduce myself as an economist, so I'll refrain from doing so. We saw an acceleration compared to the first quarter, and it was driven by iPhone and iPhone in mainland China, before we adjust for that $5 billion effect, has actually grown. Other products haven't been as successful, so we clearly have some work to do. I think last quarter it was and remains the most competitive market in the world. I wouldn't say anything else, I've said it before, I think it was last quarter too.

Moving away from the 90 day cycle, I see a lot of people moving into the middle class, we tried very good customer service and we have a lot of happy customers and you can see that in the latest store opening there. I'm still very optimistic.

14:44: Question: How do you assess the competitive landscape outside of China, what is consumer demand and receptivity to new devices? Is it related to AI or are there other drivers?

A: Generative AI opens up big opportunities across all of our devices, but it won't happen in the next quarter and we don't make product-level recommendations, but I'm extremely optimistic. That's pretty much how I look at it. If you retreat to iPhone and if you make this year-over-year adjustment, our second quarter results on iPhone will remain unchanged. Here's how we performed in the second quarter.

On the outlook, I'll reiterate what we said earlier: Color of the Quarter: We expect overall growth, we expect services growth, iPad grow, otherwise I'll let you make assumptions and then we'll let you know in 3 months.

14:46: Question: Services growth has accelerated, what parts of services have you seen, and why isn't it more stable if you drive a little lower?

A: The number of things in the services, first of all, the overall performance was very high. As I said earlier, these are record numbers in both developed and emerging markets, which is why services are doing well around the world. Entries in many of our service categories, some of them growing very quickly because they are relatively small in the service scheme: Cloud, Video, Payments. They set all-time revenue records. We are very pleased with the progress we are making in the service sector. Going forward, if you look at our growth rate a year ago, it improved during the last fiscal year. The numbers become increasingly challenging as the year progresses, but we expect double-digit growth in the June quarter, at a similar pace to the first half.

14:48: Question: For the Indian market, how much of the momentum you are seeing would you attribute to retail expansion strategy rather than supply chain changes or manufacturing changes and strategies?

A: We did have double-digit revenue growth, so we were very pleased with that. For us, this was a new revenue record for March. As I said earlier, I see this market as incredibly exciting and a core focus for us. On the operational side, we produce there. From a pragmatic point of view, to be competitive, you need to produce there. Yes, from that perspective the two are related, but we have both operational objectives and go-to-market initiatives. We opened a couple of stores last year and we see huge opportunities in them. We continue to expand our channels and also work on the developer ecosystem. We're really excited about the rapidly growing developer base there, and so we're working on the entire ecosystem, from developers to marketplace to operations and everything in between. I am very excited and delighted.

14:49: Question: At a high level, when we look at the data reported for the quarter, are people missing from iPhone from Apple? traction in iPhone market, given the data for the last quarter?

A: I can't talk about the data, I can only indicate what our results are. We accelerated last quarter and iPhone grew up in mainland China, these were the results. I can't give numbers that we didn't come up with.

14:50: Question: How would you characterize the dynamics of inventory on the channel for iPhone?

A: We reduced inventory during the quarter, which is what we typically do in the second quarter, so that's not unusual. We are very pleased with the overall volume of sales channels.

14:52: Question: Is Apple approaching the point where all emerging markets can become larger than the current Greater China segment? p>

Answer: I think you are asking a really interesting question. We recently looked at something similar. Obviously China is the largest emerging market that we have, but when we start looking at India, Saudi Arabia, Mexico, Turkey, Brazil, Indonesia, the numbers get big. We're very excited because these are markets where our market share is small, the population is large and growing, and our products are really making a lot of progress in these markets. The level of interest in the brand was very high. This is very good for us, and of course the numbers are constantly growing, the gap with China is closing, and we hope that this trajectory will continue for a long time.

14:54 : Question: Do you see ways to use capital more efficiently to drive demand for replacements, either by increasing device funding, increasing marketing investments, increasing promotions, do you need to make that kind of profit, or more importantly, drive growth through replacements?

Answer: Innovation speeds up the innovation cycle. Economic factors also play a role here, namely what offers from our carrier partners and so on, but we work with all of this. We value our products based on the value we bring. Here's how we look at it.

One of the things over a long period of time that may not be fully understood is that we have been through a long period of a very strong dollar, and what does that mean? Given that our company sells 60% of its revenue outside the United States, demand for our products in the United States is higher than the results we report simply due to the local currency conversion to dollars. This is something to keep in mind when looking at our results. Innovation, obviously, financial solutions, software trading, and we will continue to make all of these investments.

14:56: Question: What are some of the two or three best cases for Vision Pro. what are you hearing about?

A: I wouldn't say any of them are at the top right now, the most impressive thing about how people use the Mac is how they use it for everything. People use it for everything: field service, training, medical purposes such as physician prep for surgery or advanced imaging. Command and control centers are a huge number of different verticals, and we're focused on growing that ecosystem and getting more applications and more enterprises involved. At the event we recently held, the enthusiasm in the room cannot be overstated. It was unusual. We're off to a good start in the corporate business.

14:57: Question: March quarter, commodity prices were favorable, as a keepsake and things like that, in June and throughout the year. . ?

A: We are simply giving a forecast for the current quarter. We are targeting a very high gross margin level, 45.5-46.5, within this guidance we expect memory to be a slight headwind (not very much) and the same applies to foreign exchange. The negative impact is consistently around 30 basis points.

14:57: That's the end of the conversation.

Tag: Earnings[ 117 comments ]